Wednesday, July 13, 2022

Welcome to Education (Financial) Wednesdays portion of my B.R.E.A.T.H.S. blog! This is a space where I am documenting my journey to financial freedom. Last week, I started my journey with adjusting my money mindset. This week, I am sharing my money magnet tracking strategies which include a Google Sheet, a money journal in a Google Doc, and a variety of money management apps.

Learning How to Keep Track of Money

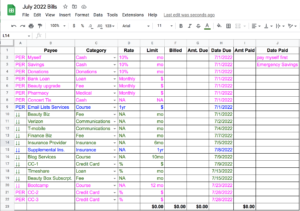

Growing up, I didn’t learn much about keeping track of money other than in my checkbook during personal finance class in high school. I only kept track of my debits and credits from my bank account and didn’t think much about keeping track of money any other way. In 2009, I learned about Google Workspace as a technology coach and started using the Google Sheets to keep track of my monthly bills. Now, I can go back and see my income and spending habits over the years. The spreadsheet started out very simple, and as my skills have evolved, so has my monthly money tracker sheet.

Starting a Money Journal or Log

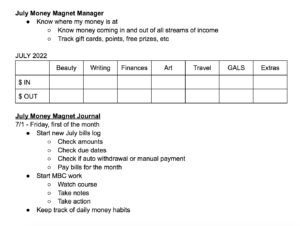

I have kept various paper and electronic journals for a handful of things: memories, gratitude, medical, food/exercise, and car maintenance. After reading the “Limitless” book, I started keeping a dream journal to exercise my memory skills, and a reading journal to track what I am learning in books. I learned that I could start tracking progress in anything to get better at it. Learning more about money was at the top of my list so I started a money journal, which is also suggested in my money boot camp that I just started a few weeks ago.

Practice Makes Progress

“Practice makes progress” is a quote that the “Limitless” book often repeats, and my progress is starting to show now that I am tracking it. Some days I might miss writing in my money journal, but I go back and write as much as I can remember or find information through transactions. Sometimes my money journal has a to-do list and other times it’s just writing down the activities for the day in paragraph format.

Conclusion

Tracking money is a great way to stay on top of your finances, especially when you are focused on becoming financially independent. There are several ways to track money like the old fashioned way in a check register, more current ways like keeping a log on digital devices, maybe the less traditional ways by keeping a money journal, and more recently we have very helpful applications we can download to track our finances. I currently use Mint and Lucky Bitch money tracking apps. What ways do you prefer to track your money magnetism?

Much gratitude reading for sharing your money tracking strategies,

Dr. Jaime Brainerd, E.d.D

I have always been one to keep track of my finances. I pay must everything with credit card so at the end of the month I pay it in full without having any interest fees to pay, plus I get cash back on my purchases! Great information!

Hi Martha, Paying with credit, paying off the credit, and receiving points or cash back incentives is a great way to build credit and earning fun rewards. That is one practice my mom did teach me a while back and I have been practicing ever since. Thank you for reading and commenting. Sending lots of love and virtual hugs to you and Lia. Jaime

I recently started budgeting per paycheck, not per month which has made me much more aware of my money but I’m still missing something. Thanks to this blog, I’m going to start a money journal. Thank you!!

Hi Kimberly, You are welcome! Thank you for reading and sharing how you track your finances. I almost just wrote the entire blog about the money journal (it’s my favorite strategy), but thought discussing a variety of finance tools might help people connect and relate. I am happy the money journal is the value you got from this post. Happy money magnet tracking! Sending love. Jaime

We decide on expenses together, but my husband is the one that uses spreadsheets to keep track of spending. We have two different ways of tracking money, and I appreciate his tenacity with the books. Spreadsheets are a good tool to use, to not only keep track of your bills and payments, but also everyday expenditures which can really add up if we aren’t watching.

Hi Angie, Sharing family finances is important and using a spreadsheet is a great way to stay organized so that everyone can keep track together, that really makes for stronger financial freedom. Thank you for reading and sharing the way you and your husband track expenses. Sending love. Jaime

Hi there, I have two comments. First I started using an excel spreadsheet almost 15 years ago when I was trying to pay down 3 or 4 credit cards (not real high, but wanted to be out of debt) and our car payment. As many will say, we started with the cards that had the highest interest rate, then worked our way down. Some will say start with the card with the lowest amount and work up. Not sure which is better, but we did the interest rate thing. Eventually all our cards and car payments (besides our house) were paid and now I do what Martha does and filter everything through a travel credit card and get money back at the end of the cycle! It’s a win-win. Btw, I still keep track of my bills in Excel so I can see how we are month to month, etc. This is what worked for us. Thanks for all the other apps out there. I may use them once we start traveling and don’t want to track things in Excel while on the road. Thanks again.

Hello Samantha, I appreciate your reflection on how you used your spreadsheets. I think your trick of paying off the highest interest first is the best idea. I have heard of people paying off the card with highest debt first, but I guess it’s depends on the amounts. For your traveling, you can upload your Excel into Google Sheets and track your finances digitally from any computer device. Thank you for reading and commenting. Happy blogging and traveling. Sending love. Jaime

What a helpful post! I’m going to check out “lucky bitch” as I want to be one, lol. Have you thought about selling your spreadsheets? The reason I ask, I recently purchased a couple of spreadsheets from a company and they are incredibly helpful to me and my business. Thank you for your post.

Hi Karen, Thank you for your comments and question. Yes, you read my mind! Next month, I will have my email list set up and I will start a bi-weekly newsletter. For signing up for my email list, I will have different offers for each of the newsletters. I was planning on offering some of my Google Docs & Sheets as freebies! Please check back soon. Sending love. Jaime