October 5, 2022

Education (financial) Wednesdays

Welcome back friends to Education Wednesdays on my B.R.E.A.T.H.S. blog. For this month, I am holding this space to share my financial education journey for each of the decades I have been through, where I am at, and where I plan to be. For each of the four weeks I will be transparent, honest, and forthcoming with successes and burdens with my financial education through the years. This first week in October, I will discuss the first decade and my experiences with money.

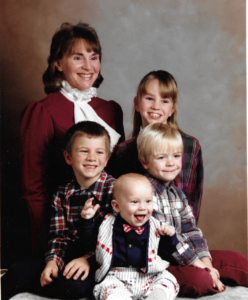

Birth, November 18, 1977

Born to Janice Brainerd, making her a mom for the first time, I was not born into money. My mom was single, living with family and friends, and working multiple jobs to make ends meet after getting fired for conceiving me with a coworker. There was lots of resentment, shame, and lack of money to start off my life.

First Couple Years

I don’t have much recollection of my first couple years, however, I do have some important events. My very first experience with money was at my first birthday when I received a doggy bank (like a piggy bank but it was a dog with a #1 on their chest), and I learned to put coins in the back slot. About six months later, I had a near death experience (NDE), where I drowned, people looked for me, found me blue, stuck under a boat dock, not breathing, and my mom was able to revive me with baby CPR. I often wonder how this NDE affected my financial destiny if I was drowning so early in life.

Two to Four Years Old

My family doubled in size from two and a half to four years old when my mom had my two middle brothers. At this age, I did not understand the concept of money, but I did know with more family members, and still a single mother, there would be a lot less for everyone. I also figured out what those coins were for my doggy bank, but was not familiar with the values just yet, even though I started school at three years old.

Five to Seven Years Old

After a few years in school, I was beginning to understand numbers, counting, and finally understanding the value of money when I lost my first tooth, and was rewarded with a $.50 cent piece. My doggy bank was filling fast, and I would strategize ways to find more coins to fill it; either under the couch, turning in soda cans/bottles in exchange for a cash refund, or just asking someone for change. This was also about the time I started attending church, and I learned about tithing or donating money to help others.

Eight to Ten Years Old

My mom had one more son when I was eight, and by ten my mom was married for the first time (not to any of our fathers), ultimately changing the dynamics of our family for the rest of our lives. During this time, I am learning about multiplication, division, and fractions, but nothing really about money or finances, except with two more mouths to feed, a deadbeat step dad with no job, and a mom who worked so hard to give us the necessities for survival. What I learned at that age is what I didn’t want for my future, so I started planning.

To be continued…My financial education journey from 11 to 20 Years will be shared a week from now on, Wednesday, October 12, 2022.

Your blogger friends will help you hold the space to discuss the first decade of your experiences with money.

OMG I have to wait a week for the next chapter?? I’ll be sitting on the edge of my seat waiting! But I have a feeling your story will have a happy ending! Hugs and love from Lia and me!