Wednesday, October 26, 2022

Education (financial) Wednesdays

Welcome back friends to Education Wednesdays on my B.R.E.A.T.H.S. blog. For this month, I am holding this space to share my financial education journey for each of the decades I have been through, where I am at, and where I plan to be. For each of the four weeks I will be transparent, honest, and forthcoming with successes and burdens with my financial education through the years as a means to reflect and grow my financial literacy knowledge.

My Financial Education Journeys

The first week in October, I shared about the first decade of my experiences with money and a family of four children under ten living with our single mother. During week two, I discussed my financial education journey during my teen years. Last week, I reviewed two decades, two marriages, two divorces, and a third chance at learning about money and finances. This fourth and final week, I am sharing the last (almost) five years of my financial journey.

Fortieth Year = Midlife Crisis

My fortieth year was what some may term as a mid-life crisis that included:

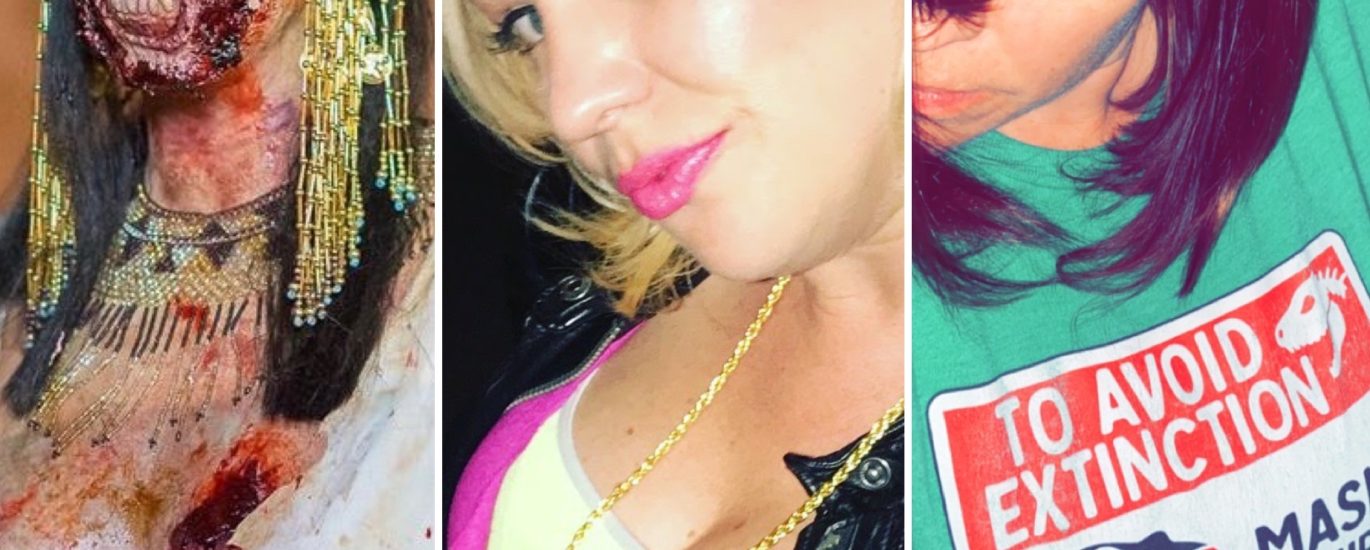

- changed my hair dramatically from fiery red, to platinum blonde, to zombie black

- a breakup of a seven year relationship

- discovery of a full-body genetic disability (hEDS) that stopped me from working as a classroom teacher for 20 years and was granted medical leave

- my body was inflamed with several diseases

- ungracefully moved out of two homes in CA (spraining ankles each time)

- filed for bankruptcy for the first time as my lifelong income source disappeared

- packed all my belongings in my car with a small storage-hauler to head back to home base in the PNW

- when visiting Vegas right before my 41st birthday, I was drugged and mugged

At that point, I felt like a complete waste of human space (hence the zombie outfits), a constant victim of negative circumstance, and I was literally bursting at the seams in every area of my life. Almost five years later, I look back on that time with gratitude, as that is what it took for me to shift my life in the opposite direction towards the positive.

The Real Beginning of My Financial Journey

The beginning of my financial journey started with someone questioning me about my finances. One day after school, a substitute teacher came into my classroom to talk about my class she had covered in the past. We started talking and she asked about my finances. To be honest, I was a bit caught off guard, because that’s not really a topic anyone discusses, especially with someone you just met. However, after I got home that night, I thought about the financial questions, and realized no one had ever asked me that before, so I called her back to find out more. I am so happy and grateful she asked.

Finding Out About Financial Literacy

That night, my friend and I talked about my financial goals. She educated me on retirement savings, freedom from debt, proper insurance protection, short/long term savings, and how to preserve wealth through multiple streams of income. At forty, I was wondering why I never learned this stuff in school as a student, teacher, or professor! This is when I realized that I needed to brush up on my financial literacy, so I joined their financial education team, bought a bunch of financial books, and I also reactivated my beauty advisor services.

Finishing Doctoral School

A few weeks after joining, I passed my health/life insurance exam and was a licensed agent in the state of California. Unfortunately, two months later, I moved out of state and lost my connection with my financial team. I told them I would be back once I finished my goal of completing my doctorate in education, which I had been working on for close to a decade. A few more years later, I finally finished in March of 2020, defending my dissertation on Zoom (my first time using it, definitely not my last), the same week the entire world was shutting down for Covid.

Connecting Through Covid

Did you hear the trumpets blaring? Well, I did! From my perspective, the entire world was starting to experience a level of crisis that I just went through, and I had been intentionally healing every part of my life (health, money, love). I felt 100% better equipped to deal with what was coming than just a few years prior. I probably would have burst an organ, or something worse, death, which I survived, so I knew I could beat the Corona Virus. Plus, I was connecting with more people than ever: my at-home beauty biz was booming, my financial team exploded across the states, my health was on-point, my lifelong study of distance learning has paid off (that is what my dissertation is on), I was creating paintings again, and I was ready to use this time to rev things into positive gear, literally.

Jaime’s Journey Across the United States

In August 2020, I started my educational nonprofit, Global Alternative Learning Systems (GALS Nonprofit), and in September, I took off on a two-year 49 state (saving Alaska for my 50th year) research tour of the United States stopping at over 120 National Parks (most of the outdoor parks were open and some indoor visitors centers with restrictions). I learned more about art, cuisines, culture, geography, geology, history, literature (listened to a book a day), music, math, meteorology, physical education (in nature), and social studies in those two years than I did with a combined 30 years of being involved with institutionalized education at every level. What I also found, is that most Americans have little to no financial literacy just like me.

Financial Future

On my past financial journey, I have seen many ups and downs, and one major shift in my mindset on wanting to be free from debt, pain, and a broken heart. Presently, I am working in the beginning stages of building multiple streams of income by using my God-given talents and creating the life I desire which includes: doing work I enjoy, positive flow of finances, traveling the world, freedom from pain, and lots of love. For my financial future, I plan to: get out of debt (mostly school loans left), position myself for comfortable retirement, protect my money, then move and invest my money (still learning that process). In the meantime, I am passing on what I have learned about financial literacy on to you and future generations.

Thank you for reading and viewing,

You’ve had an amazing journey and I love how you are making a difference because of it. Thanks for being vulnerable and transparent for others to see that there is another side.

I would love to take a cross-country road trip! What a wonderful experience despite the pandemic.

What a journey you have had before you took your cross-country journey! You are an amazing lady, others would have quit a long time ago but you kept going and found answers! I hope you have your financial journey complete now. Hugs and love from Lia and me.